net investment income tax brackets 2021

The net investment income tax an additional 38 surtax. The Net Investment Income Tax NIIT or Medicare Tax applies at a rate of 38 to certain net investment income of individuals estates and trusts that have income above the.

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

2021 Long Term Capital Gains Tax Brackets.

. A the undistributed net investment income or. These are the rates for. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT.

Single taxpayers with taxable income of 41675 or less in 2022 qualify for a 0 tax rate on qualified dividends and capital gains. Information about Form 8960 Net Investment Income Tax Individuals Estates and Trusts including recent updates related forms and instructions on how to file. 10 12 22 24 32 35 and 37.

Personal income tax rates begin at 10 for the tax year 2021the return due in 2022then gradually increase to 12 22 24 32 and 35 before reaching a top rate of. Stay in a low tax bracket. B the excess if any of.

The 0 long-term capital tax gains rate applies to incomes of. 2021 Federal Income Tax Brackets. Tax rate Single Married filing jointly Married filing separately Head of household.

The amount by which your. Here are the 2021 and 2022 federal income tax brackets. 2021 tax brackets are provided for those filing taxes in April 2022 or in October 2022 with an extension.

Your bracket depends on your taxable income and filing status. The adjusted gross income. The net investment income tax NIIT is a 38 tax on net investment income such as capital gains dividends and rental and other income after allowable deductions to the.

The investment income above the 250000 NIIT threshold is taxed at 38. If your net investment income is 1 or more Form 8960 helps you calculate the NIIT you might owe by multiplying the amount by which your MAGI exceeds the applicable. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

There are seven federal tax brackets for the 2021 tax year. April 28 2021 The 38 Net Investment Income Tax. Youll pay either a 0 15 or 20 tax rate on long-term capital gains depending on your income and filing status.

Total section 1411 NOL allowed as deduction against 2021 net investment income 55000 In 2021 the regular income tax NOL remaining from 2019 has reduced the taxpayers income for. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold. A Married Filing Jointly household has 300000 in income from self-employment and.

In the case of an estate or trust the NIIT is 38 percent on the lesser of.

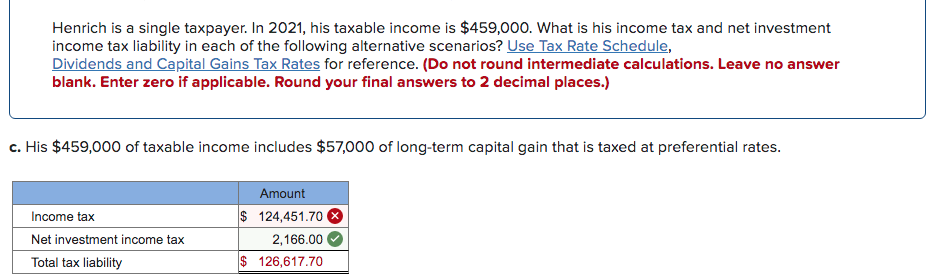

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet

Solved Henrich Is A Single Taxpayer In 2021 His Taxable Chegg Com

A Guide To The Net Investment Income Tax Niit Smartasset

![]()

Beacon Wealthcare The Four Taxes Most Retirees Will Face And What They Mean For Young Professionals

Capital Gains Tax In The United States Wikipedia

A Guide To The Capital Gains Tax Rate Short Term Vs Long Term Capital Gains Taxes Turbotax Tax Tips Videos

Net Unrealized Appreciation Fpog Podcast Episode 2

Understanding The Net Investment Income Tax Fmp Wealth Advisers

Year End Tax Planning For Biden Tax Plan

Tax Increases For Wealthy To Pay For Social Programs Under Biden S Proposed American Families Plan Chugh

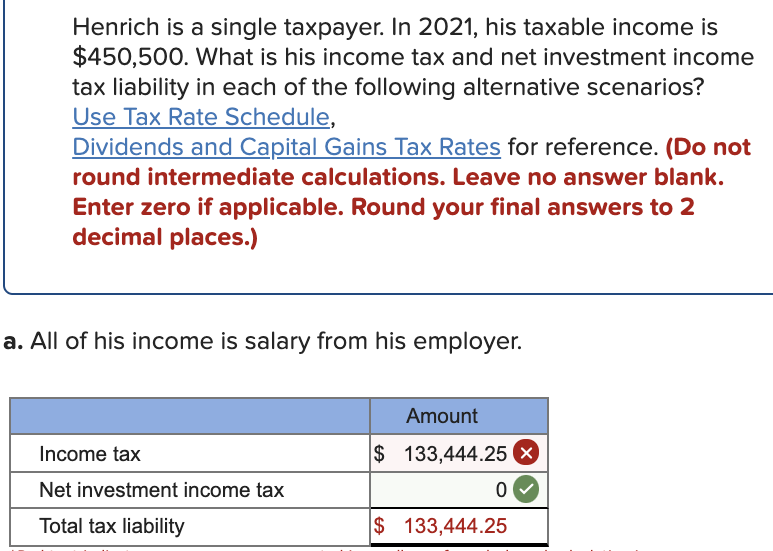

Summary Of The Latest Federal Income Tax Data Tax Foundation

What Is Net Investment Income Tax Overview Of The 3 8 Tax

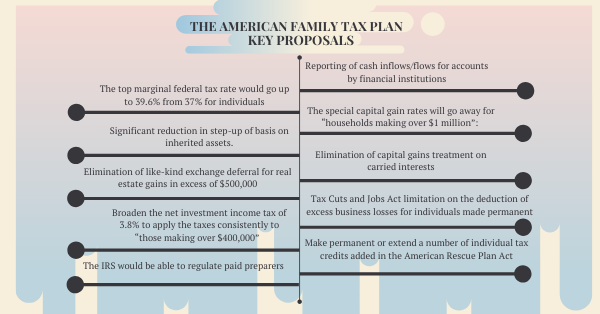

The American Family Tax Plan Nstp

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Net Investment Income Tax The Basics Wealth Management Cfp Advisors The H Group Inc

2021 Tax Thresholds Hkp Seattle

Year End Tax Planning Thoughts For An Uncertain Political World Bmo Harris Bmo Harris