sacramento tax rate calculator

You can find more tax. The Sacramento California sales tax is 825 consisting of 600 California state sales tax and 225 Sacramento local sales taxesThe.

Sacramento is located within.

. Ad File Your State And Federal Taxes With TurboTax. This includes the rates on the state county city and special levels. This tax has existed since 1978.

Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Sacramento totaling 075. See Why Were Americas 1 Tax Preparer. For comparison the median home value in Sacramento County is.

The average cumulative sales tax rate in Sacramento California is 841. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. The minimum combined 2022 sales tax rate for Sacramento California is.

What is the sales tax rate in Sacramento California. This is the total of state county and city sales tax rates. Revenue and Taxation Code Section.

What is the sales tax rate in Sacramento California. The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. Sacramento in California has a tax rate of 825 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax.

025 to county transportation funds. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. The current total local sales tax rate in Sacramento CA is 8750.

It is mainly intended for residents of the US. See If You Qualify To File State And Federal For Free With TurboTax Free Edition. View the E-Prop-Tax page for more information.

075 to city or county operations. This tax is charged on all NON-Exempt real property transfers that take place in the City limits. Sacramento County collects on average 068 of a propertys.

Revenue and Taxation Code Sections 605115 620115. A supplemental tax bill is created when a property is reassessed from a change in. The property tax rate in the county is 078.

Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. Download all California sales tax rates by zip code.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 819 in Sacramento County. Ad Find Deals on turbo tax online in Software on Amazon.

Discover Helpful Information And Resources On Taxes From AARP. Sacramento CA Sales Tax Rate. The December 2020 total local sales tax rate was also 8750.

You can view property information and estimate supplemental taxes. Sales Tax Table For Sacramento County California. Permits and Taxes facilitates the collection of this fee.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. And is based on.

Fha Loan Limit Calculator Fha Mortgage Limits Freeandclear Mortgage Refinance Calculator Mortgage Amortization Calculator Refinance Calculator

2022 Best Sacramento Area Suburbs To Live Niche

Death Information Sacramento County Employees Retirement System

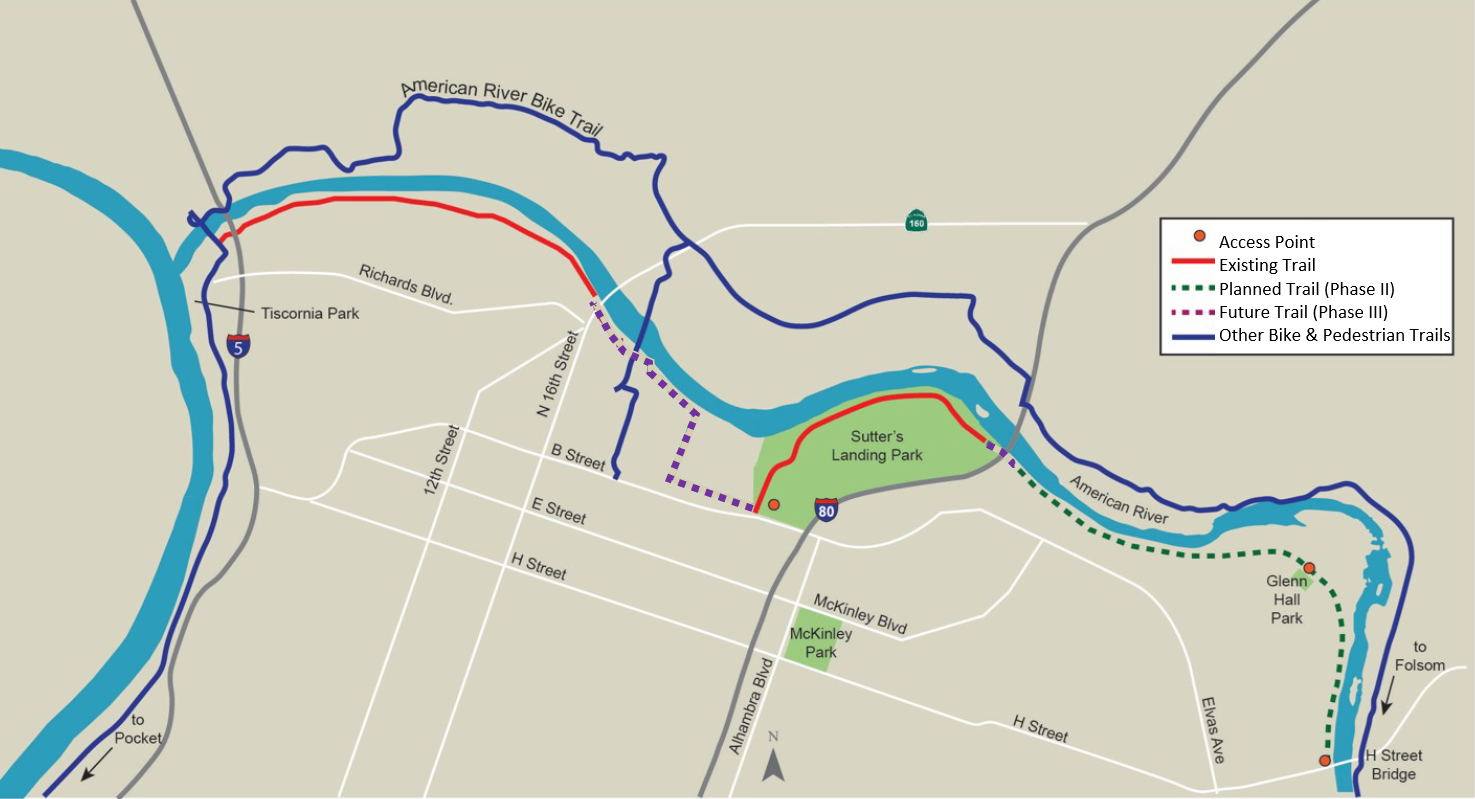

Two Rivers Trail Phase Ii City Of Sacramento

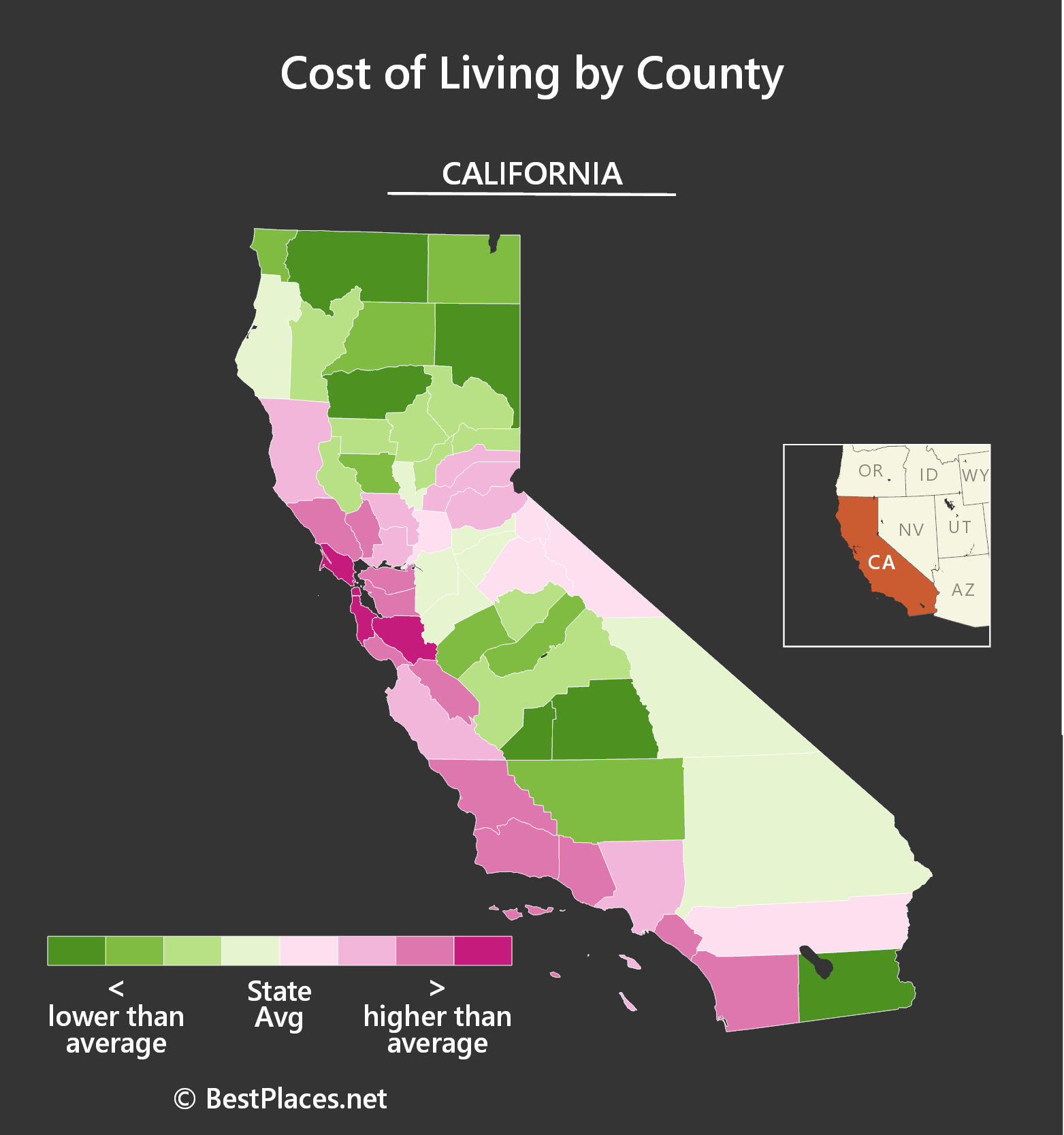

Best Places To Live In Sacramento California

Pin On Gobig Real Estate Realtors Home Inspection

Map Of City Limits City Of Sacramento

Services Rates City Of Sacramento

Taxi Fare Calculator Sacramento California

Sacramento County Transfer Tax Who Pays What

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Top 20 Cities In U S For Investing In Real Estate Rentals

Sacramento California Local Barber Shop Photo Photography Portfolio Photography Branding Branding Photos